Conas meánráta fáis bliantúil / cumaisc in Excel a ríomh?

Tá an t-alt seo ag caint ar bhealaí chun an Meánráta Fáis Bliantúil (AAGR) agus an Ráta Fáis Bliantúil Comhdhéanta (CAGR) a ríomh in Excel.

- Ríomh ráta fáis bliantúil cumaisc in Excel

- Ríomh ráta fáis bliantúil cumaisc le feidhm XIRR in Excel

- Ríomh an meánráta fáis bliantúil in Excel

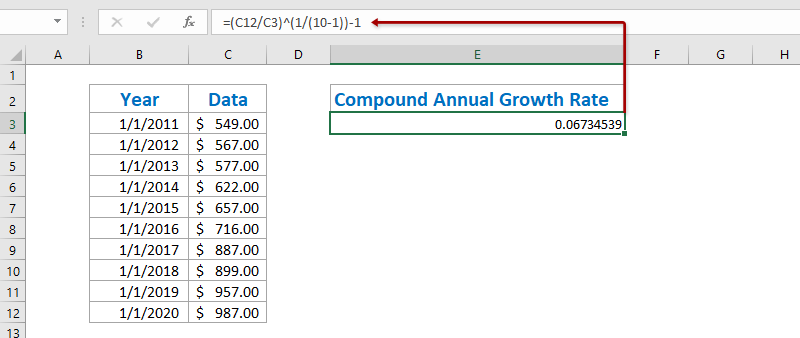

Ríomh an Ráta Fáis Bliantúil Comhdhéanta in Excel

Chun an Ráta Fáis Bliantúil Comhdhéanta a ríomh in Excel, tá foirmle bhunúsach ann = ((Luach Deiridh / Luach Tosaigh) ^ (1 / Tréimhsí) -1. Agus is féidir linn an fhoirmle seo a chur i bhfeidhm go héasca mar a leanas:

1. Roghnaigh cill bhán, mar shampla Cill E3, cuir isteach an fhoirmle thíos inti, agus brúigh an Iontráil eochair. Féach an pictiúr:

=(C12/C3)^(1/(10-1))-1

Nóta: San fhoirmle thuas, is í C12 an chill le luach deiridh, is í C3 an chill le luach tosaigh, is é 10-1 an tréimhse idir luach tosaigh agus luach deiridh, agus is féidir leat iad a athrú bunaithe ar do chuid riachtanas.

2. I roinnt cásanna, ní fhéadfaidh toradh an ríofa formáidiú mar chéatadán. Coinnigh toradh an ríofa le do thoil, cliceáil an Stíl Céatadáin cnaipe ![]() ar an Baile cluaisín chun an uimhir a athrú go formáid chéatadáin, agus ansin na háiteanna deachúlacha a athrú trí chliceáil ar an Deachúil a Mhéadú cnaipe

ar an Baile cluaisín chun an uimhir a athrú go formáid chéatadáin, agus ansin na háiteanna deachúlacha a athrú trí chliceáil ar an Deachúil a Mhéadú cnaipe ![]() or Laghdaigh Deachúil cnaipe

or Laghdaigh Deachúil cnaipe ![]() . Féach griangraf:

. Féach griangraf:

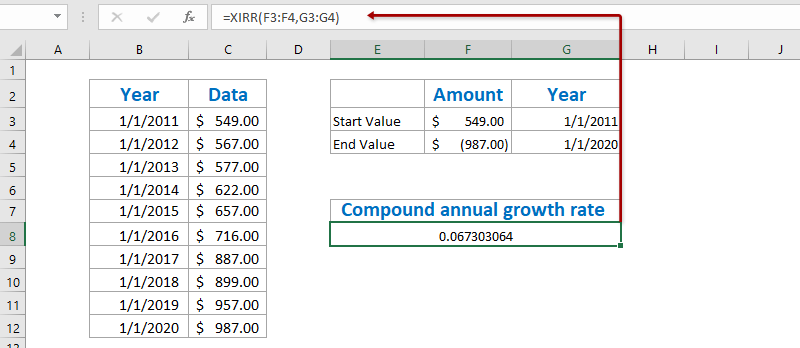

Ríomh ráta fáis bliantúil cumaisc le feidhm XIRR in Excel

I ndáiríre, is féidir le feidhm XIRR cabhrú linn an Ráta Fáis Bliantúil Comhdhéanta in Excel a ríomh go héasca, ach éilíonn sé ort tábla nua a chruthú leis an luach tosaigh agus an luach deiridh.

1. Cruthaigh tábla nua leis an luach tosaigh agus an luach deiridh mar a thaispeántar an chéad ghrianghraf scáileáin seo a leanas:

Nóta: I gCill F3 iontráil = C3, i gCill G3 cuir isteach = B3, i gCill F4 cuir isteach = -C12, agus i gCill G4 cuir isteach = B12, nó is féidir leat do chuid sonraí bunaidh a iontráil sa tábla seo go díreach. Dála an scéil, ní mór duit lúide a chur leis roimh an Luach Deiridh.

2. Roghnaigh cill bhán faoin tábla seo, cuir isteach an fhoirmle thíos inti, agus brúigh an Iontráil eochair.

= XIRR (F3: F4, G3: G4)

3. Chun an toradh a athrú go formáid chéatadáin, roghnaigh an Cill leis an bhfeidhm XIRR seo, cliceáil an Stíl Céatadáin cnaipe ![]() ar an Baile cluaisín, agus ansin athraigh a áiteanna deachúla trí chliceáil ar an Deachúil a Mhéadú cnaipe

ar an Baile cluaisín, agus ansin athraigh a áiteanna deachúla trí chliceáil ar an Deachúil a Mhéadú cnaipe ![]() or Laghdaigh Deachúil cnaipe

or Laghdaigh Deachúil cnaipe ![]() . Féach griangraf:

. Féach griangraf:

Sábháil an tábla CAGR go tapa mar mhion-theimpléad, agus athúsáid le cliceáil amháin sa todhchaí

Caithfidh sé a bheith an-tedious cealla a tharchur agus foirmlí a chur i bhfeidhm chun na meáin a ríomh gach uair. Soláthraíonn Kutools for Excel sreabhadh oibre gleoite de Téacs Uathoibríoch fóntais chun an raon a shábháil mar iontráil AutoText, ar féidir leis fanacht sna formáidí agus na foirmlí cille sa raon. Agus ansin athúsáidfidh tú an raon seo gan ach cliceáil amháin.

Ríomh Meánráta Fáis Bliantúil in Excel

Chun an Meánráta Fáis Bliantúil a ríomh ar fheabhas, de ghnáth ní mór dúinn rátaí fáis bliantúla gach bliana a ríomh leis an bhfoirmle = (Luach Críochnaithe - Luach Tosaigh) / Luach Tosaigh, agus ansin na rátaí fáis bliantúla seo a mheánú. Is féidir leat a dhéanamh mar a leanas:

1. Seachas an tábla bunaidh, cuir isteach an fhoirmle thíos sa Chill bán C3 agus, agus ansin tarraing an Láimhseáil Líon isteach chuig Raon C3: C11.

= (C4-C3) / C3

2. Roghnaigh Raon D4: D12, cliceáil an Stíl Céatadáin cnaipe ![]() ar an Baile cluaisín, agus ansin athraigh a áiteanna deachúla trí chliceáil ar an Deachúil a Mhéadú cnaipe

ar an Baile cluaisín, agus ansin athraigh a áiteanna deachúla trí chliceáil ar an Deachúil a Mhéadú cnaipe ![]() or Laghdaigh Deachúil cnaipe

or Laghdaigh Deachúil cnaipe ![]() . Féach an pictiúr:

. Féach an pictiúr:

3. Meánráta an fháis bhliantúil ar fad agus an fhoirmle seo a iontráil i gCill F4, agus brúigh an Iontráil eochair.

= FÍOR (D4: D12)

Go dtí seo, rinneadh Meánráta Fáis Bliantúil a ríomh agus a thaispeáint i gCill C12.

Taispeántas: ríomh meánráta fáis bliantúil / cumaisc in Excel

Earraí gaolmhara:

Uirlisí Táirgiúlachta Oifige is Fearr

Supercharge Do Scileanna Excel le Kutools le haghaidh Excel, agus Éifeachtúlacht Taithí Cosúil Ná Roimhe. Kutools le haghaidh Excel Tairiscintí Níos mó ná 300 Ardghnéithe chun Táirgiúlacht a Treisiú agus Sábháil Am. Cliceáil anseo chun an ghné is mó a theastaíonn uait a fháil ...

Tugann Tab Oifige comhéadan Tabbed chuig Office, agus Déan Do Obair i bhfad Níos Éasca

- Cumasaigh eagarthóireacht agus léamh tabbed i Word, Excel, PowerPoint, Foilsitheoir, Rochtain, Visio agus Tionscadal.

- Oscail agus cruthaigh cáipéisí iolracha i gcluaisíní nua den fhuinneog chéanna, seachas i bhfuinneoga nua.

- Méadaíonn do tháirgiúlacht 50%, agus laghdaíonn sé na céadta cad a tharlaíonn nuair luch duit gach lá!